Understanding How Pocket Option High Signals Work

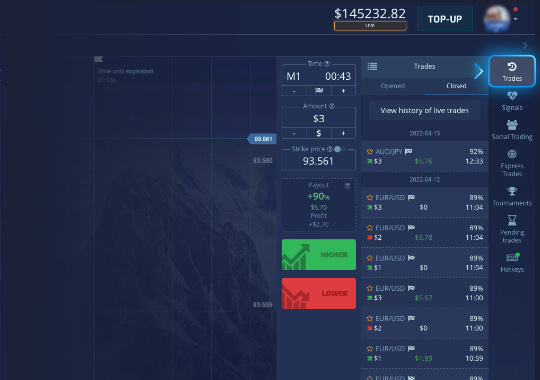

Pocket Option has become one of the most recognized platforms for traders seeking to navigate the volatile waters of financial markets. A core feature that attracts many traders is the pocket option high signals work pocket option high signals work, which offers traders the opportunity to receive valuable insights into market trends and potential profitable trades. In this article, we will delve deep into how these signals function, their benefits, and some strategies you can adopt to maximize your trading success using them.

The Concept of Trading Signals

Trading signals are indicators that assist traders in making informed decisions. They provide insights based on market analysis, utilizing various data points such as historical prices, trading volumes, and market sentiment. In the context of Pocket Option, high signals are designed to identify potentially profitable trades by analyzing patterns and trends within the market.

How Do Pocket Option High Signals Work?

The high signals generated by Pocket Option are based on advanced algorithms that consider multiple factors. Here’s how they function:

- Data Analysis: Signals are derived from analyzing vast amounts of trading data, including price movements and historical performance.

- Indicator Use: Various technical indicators such as Moving Averages, RSI (Relative Strength Index), and Bollinger Bands are employed to forecast potential market behavior.

- Market Sentiment: Understanding overall market sentiment can significantly influence trading decisions, and signals take into account the sentiments exhibited by other traders.

Types of Signals Offered by Pocket Option

Pocket Option provides several types of trading signals to cater to the diverse needs of traders. Here are some notable types:

- High Probability Signals: These signals are identified using statistical analysis, providing traders with opportunities that are deemed to have a higher chance of success.

- Trend-Based Signals: These focus on the overarching market trends, advising traders on whether to follow the trend or anticipate a reversal.

- News-Based Signals: Economic news and events can have a significant impact on the market, and these signals aim to leverage that information to suggest timely trades.

Benefits of Utilizing High Signals

Utilizing high signals from Pocket Option can provide several advantages for traders:

- Informed Decisions: Receiving signals allows traders to make decisions based on analytical predictions rather than emotions or guesswork.

- Time Efficiency: Instead of spending hours analyzing the market, traders can rely on signals to streamline their trading process.

- Risk Management: High signals can help traders set stop-loss and take-profit limits more effectively, allowing for better risk management.

Effective Strategies to Maximize Trading with Signals

To leverage Pocket Option high signals effectively, consider the following strategies:

1. Combine Signals with Personal Analysis

While trading signals provide great information, pairing them with your market analysis is essential. Familiarize yourself with how the market behaves and understand why the high signal was generated.

2. Stay Updated with Market News

Market conditions can change rapidly due to news events. Thus, staying informed on current events helps you adjust your strategies accordingly and respond to signals in real-time.

3. Practice Risk Management

Never risk more than you can afford to lose. Use the insights provided by high signals to implement solid risk management strategies, such as diversifying your trades and setting stop-loss orders.

Conclusion

In conclusion, understanding how Pocket Option high signals work is crucial for traders looking to enhance their trading efficiency and profitability. By leveraging these signals and combining them with personal analysis, traders can navigate the market with increased confidence and strategic insight. Remember to remain disciplined, manage your risks, and continue learning about market behaviors. With time and practice, the use of high signals can lead to significant improvements in your trading outcomes.