Mastering the Volume Indicator on Pocket Option

The volume indicator pocket option volume indicator pocket option is a powerful tool that traders can utilize to gain insights into market dynamics. Understanding how to interpret volume data effectively can vastly improve your trading strategies. In this article, we delve into the concept of the volume indicator, its relevance in price action trading, and how to integrate it into your trading toolkit.

Understanding the Volume Indicator

The volume indicator is a graphical representation of the number of shares or contracts that change hands over a specified period. In the context of Pocket Option, volume reflects the activity of traders and market participants, thus serving as a crucial gauge of strength behind price movements.

In essence, the volume indicator helps traders understand whether a price movement is supported by substantial trading interest. For instance, if the price rises while the volume increases, it indicates strong buyer interest and could suggest that the trend will continue. Conversely, if the price increases but the volume declines, it might signal a lack of conviction in the price move, indicating potential reversal.

Why Volume is Important in Trading

Volume is often considered one of the most critical indicators in trading for several reasons. Firstly, it serves as a confirmation tool. Traders often use volume to confirm price movements. A price breakout on high volume offers more credibility than a breakout on low volume, reinforcing the belief that the price change is significant.

Secondly, volume analysis helps identify trends. By observing volume spikes, traders can ascertain whether there is a genuine interest in a particular asset, allowing them to make informed trades. Lastly, volume can provide early signals for potential reversals. Unusually high volume during a price decline, for instance, could indicate that selling pressure is likely peaking, and a reversal could be imminent.

Types of Volume Indicators

There are several types of volume indicators that traders use to analyze market conditions:

- On-Balance Volume (OBV): This indicator adds volume on up days and subtracts it on down days, helping traders identify the momentum behind price movements.

- Accumulation/Distribution Line: This indicator indicates the cumulative flow of money into and out of a security, giving insights into the buying and selling pressure.

- Chaikin Money Flow (CMF): CMF combines both the price and volume to gauge the buying and selling pressure over a specific timeframe, providing a clear picture of market sentiment.

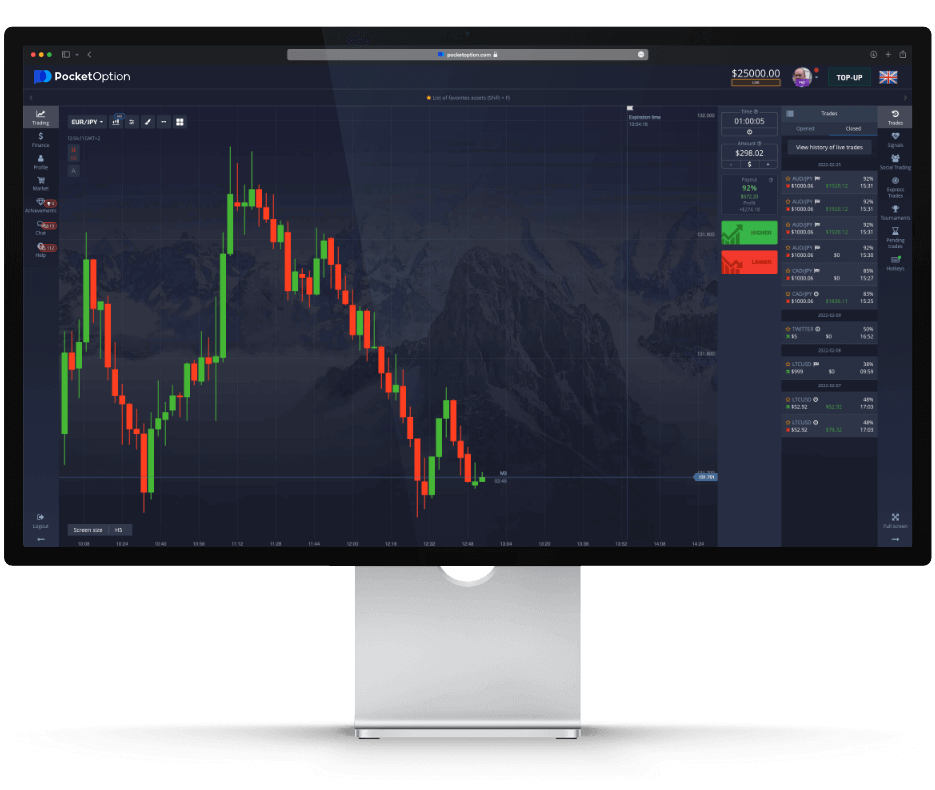

Integrating the Volume Indicator into Pocket Option Trading

Incorporating the volume indicator into your trading strategy on Pocket Option enhances your analytical capability and decision-making process. Here are steps to effectively apply volume indicators:

- Analyze Volume Trends: Start by observing how volume changes in relation to price movements. Increase your awareness of scenarios where volume spikes occur alongside significant price fluctuations.

- Use Volume with Other Indicators: Pair volume analysis with other technical indicators like Moving Averages or Relative Strength Index (RSI) for a more comprehensive approach. This multifaceted strategy can reinforce your trading signals.

- Set Volume Alerts: Utilize the alert features on Pocket Option to notify you when specific volume thresholds are crossed, allowing you to take prompt action based on your analysis.

- Practice in a Demo Account: If you’re new to trading with volume indicators, consider using a demo account to practice your strategies without risking real money. Experiment with different approaches to find what works best for you.

Common Mistakes to Avoid

While the volume indicator is a valuable asset in your trading toolbox, it’s essential to avoid common pitfalls:

- Over-reliance on Volume Alone: Volume should be used in conjunction with other indicators and not as a standalone signal. Every indicator has its limitations, and relying solely on volume can lead to erroneous decisions.

- Ignoring Context: Consider the broader market context when analyzing volume. Different assets may behave differently based on market conditions, news events, and investor sentiment.

- Neglecting Risk Management: Always practice sound risk management regardless of the signals provided by the volume indicator. Set stop-loss orders and manage your exposure to minimize potential losses.

Conclusion

The volume indicator pocket option serves as an indispensable tool for traders looking to enhance their trading strategies. Through careful analysis of volume trends and patterns, traders can make more informed decisions, leading to higher success rates in trading. Whether you are a novice or an experienced trader, understanding volume analysis is essential in navigating the complexities of the financial markets.

As you integrate the volume indicator into your trading routine, remember that constant learning and adaptation are key to success. Monitor your performance, adjust your strategies accordingly, and maintain a disciplined approach to trading. Happy trading!